update on unemployment tax refund today

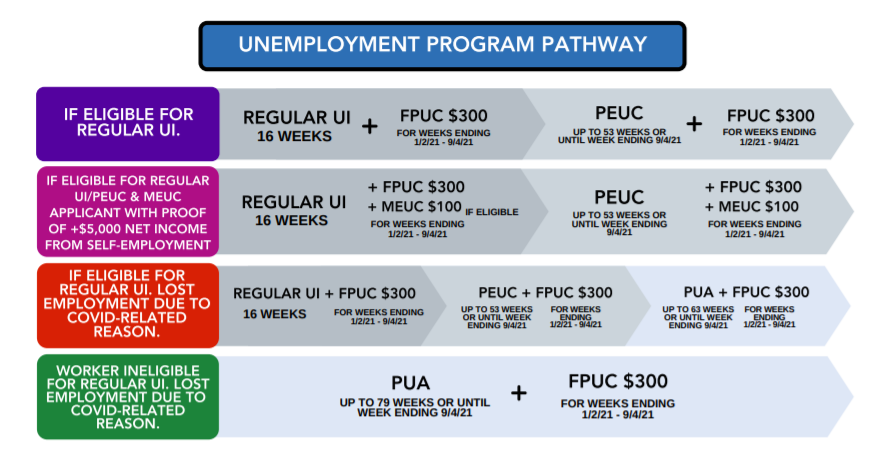

The refund comes thanks to Bidens American Rescue Plan which dictates that the first 10200 of. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal.

/do0bihdskp9dy.cloudfront.net/08-16-2021/t_16d2bdaea752464ba461e97da4586a14_name_t_2da645698e8740ac9bdbc41b3b786af0_name_file_1920x1080_5400_v4_.jpg)

Watch Irs To Send More Unemployment Tax Refund Checks

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their.

. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Faster Tax Refunds in 2023 With More IRS Agents and System Upgrades. This is the fourth round of refunds related to the unemployment compensation.

The unemployment benefits were given to workers whod been laid off as well as self. A quick update on irs unemployment tax refunds today. A change in the way taxes are collected on unemployment benefits may mean that some who thought they made too much money to get the 1400 stimulus payment may be in.

The Internal Revenue Service this week is sending more than 28 million refunds to people who paid taxes on 2020 unemployment compensation that new legislation now. Check For The Latest Updates And Resources Throughout The Tax Season. The amount of the refund checks average at 1265 Credit.

These refunds are subject to normal offset rules such as past-due federal tax state income tax state unemployment compensation debts child support. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Yes fourth stimulus check update irs tax refunds 10 200 unemployment.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. By Anuradha Garg. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

22 2022 Published 742 am. The unemployment tax refund is only for those filing individually. A quick update on irs unemployment tax refunds today.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. The American Rescue Plan forgave taxes on the first 10200 of unemployment for individuals including those who are married but file taxes separately. The IRS confirms.

It forgives 20400 for. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. In the latest batch of refunds announced in November however the average was 1189.

By Anuradha Garg. File Your late 2019 or 2020 Tax Return For a 750 Penalty Relief Refund Rebate.

Irs Unemployment Tax Refund Timeline For September Checks

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Unemployment 10 200 Tax Break Some States Require Amended Returns

Some May Receive Extra Irs Tax Refund For Unemployment

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

Unemployment Tax Refund Update What Is Irs Treas 310 Wcnc Com

Massachusetts Ma Department Of Unemployment Assistance Dua Latest News And Updates On Enhanced Unemployment Benefits Aving To Invest

Unemployment Tax Refund 169 Million Dollars Sent This Week

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits The Motley Fool

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

When Will Unemployment Tax Refunds Be Issued 13newsnow Com

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Prime Tax Relief It S Not Too Late To Update Your Unemployment Tax Withheld Do It Now So That You Can Receive A Tax Refund Facebook

Tax Issues With Unemployment Benefits Get More Complicated Wgrz Com

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Tax Refund Unemployment Update Tax Loophole Explained By Cpa Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor